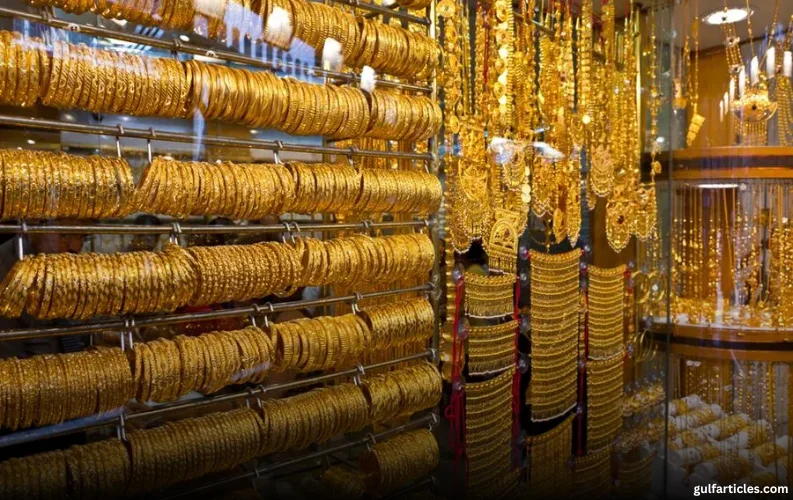

The surge in global gold prices is pushing Dubai’s local rate for 22K gold closer to the symbolic Dh400 mark, following a sharp rise that has stunned both traders and shoppers across the UAE. As of Tuesday morning, the 22K gold rate in Dubai reached Dh381.5 per gram, marking a jump of Dh10.25 since April 20.

This rapid escalation in price reflects broader global trends, with bullion trading at nearly $3,460 per ounce in international markets. Analysts now believe the metal is well-positioned to test the $3,500 level, as ongoing economic uncertainties continue to elevate gold’s appeal as a safe-haven asset.

Consumer Strategy Shifts Amid Price Shock

Faced with this historic rally, UAE gold buyers are changing their strategy. Rather than exchanging old jewellery for new, many residents are opting to buy outright, banking on further gains in the current market cycle.

“Gold shoppers have gotten a price shock – but they’ve been quick to change their ways,”

said Shamlal Ahmed, Managing Director – International Operations at Malabar Gold & Diamonds.

“They are holding off on exchanges because they believe the value of their old jewellery could grow even more.”

This sentiment shift is echoed across the market. The Saudi gold rate for 22K also climbed to SR388, reflecting the broader Gulf trend of rising consumer demand amid high prices.

October 2024: A Turning Point

The UAE gold market first broke past the Dh300 per gram barrier for 22K in October 2024, signaling a long-term uptrend that has accelerated in 2025.

“Gold price volatility is here to stay,”

said Karim Merchant, CEO of Pure Gold.

“Customers are adapting to the new norm and continue buying with confidence. Gold remains the only asset that consistently outperforms in uncertain times.”

A Market Powered by Fear and Fundamentals

The current rally in gold is being fueled by multiple global headwinds — tariff uncertainties, a weakening U.S. dollar, and fears of recession in key economies. Investors are turning to gold as a hedge against inflation and geopolitical instability.

Those who bought gold just weeks ago are now sitting on significant gains. A single 28-gram investment (approximately one ounce) has appreciated by nearly $1,000, reaffirming gold’s position as one of the most reliable stores of value during turbulent times.

Outlook: Should Buyers Wait?

While some shoppers are hesitant, hoping for a correction, market analysts warn that prices are unlikely to dip in the near term.

“The only certainty is that gold will continue to power through,” one trader told BOL7. “As long as global markets remain uncertain, gold has only one direction — up.”

For now, UAE consumers face a critical decision: buy before prices climb further, or wait and risk missing out. Either way, gold’s historic rally is reshaping buying behavior in one of the world’s most active retail gold markets.