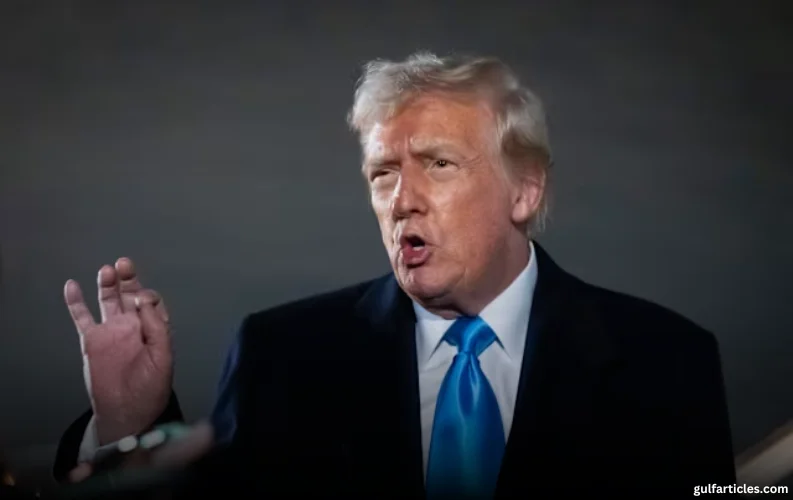

New York – U.S. equities rebounded sharply on Wednesday following President Donald Trump’s decision to pause new tariffs for 90 days on all countries except China, a move that momentarily calmed investors rattled by escalating trade tensions.

In a dramatic turnaround on Wall Street, the S&P 500 surged 6.0% to close at 5,281.44, marking its best single-day performance of the year and ending a steep slide triggered by last week’s tariff escalation.

The rally came shortly after Trump posted the announcement on Truth Social, signaling a softening of his recent aggressive trade stance and offering a temporary reprieve to U.S. allies and trading partners.

Markets React to Sudden Shift

The President’s statement appears to have reversed investor pessimism that followed his “Liberation Day” policy unveiled a week earlier, which had rattled global markets and sparked concerns of a broader economic slowdown.

The Dow Jones Industrial Average jumped more than 1,800 points, while the Nasdaq Composite climbed nearly 5.5%, driven by gains in tech and manufacturing stocks that had been hardest hit by fears of retaliatory tariffs.

“This is a clear signal that the administration is trying to calm markets while maintaining a hard line on China,” said Marissa Caldwell, senior strategist at Crosswave Capital. “The message is that allies are being given a diplomatic window—China is not.”

China Still in Crosshairs

While the tariff relief provided a temporary market boost, Trump reaffirmed his firm stance on Beijing, maintaining a 125% tariff rate on Chinese imports, citing China’s "lack of respect for global market stability."

The contrast in treatment underscores the administration’s broader trade strategy: isolating China while encouraging negotiations with other global partners.

“It’s not a full reversal, but rather a recalibration,” noted Caldwell. “Markets responded positively to the clarity and partial easing.”

Outlook Ahead

Investors are now eyeing further developments from the White House and any signals from the Federal Reserve regarding inflation and interest rate direction. Analysts suggest that while the market relief rally reflects optimism, volatility could persist if trade talks with China deteriorate or if the tariff pause ends without diplomatic progress.

The 90-day window now becomes a critical period for global trade diplomacy, corporate earnings outlooks, and broader market sentiment.