The rapid expansion of artificial intelligence is forcing the world’s largest technology companies to build their own power plants as electricity demand from data centres accelerates faster than public grids can support.

Industry estimates indicate that AI-driven data centres could consume 8–10 per cent of total US electricity by 2030, driven by the rising energy requirements of AI training and inference workloads. At the same time, delays in grid connections,often stretching three to five years, are pushing companies to secure alternative sources of power to maintain operations.

Data centres, which underpin cloud computing, streaming services and AI platforms, are among the most energy-intensive facilities in the modern economy. Servers can account for up to 60 per cent of total power use, while cooling systems consume between 30 and 40 per cent, according to industry data.

The International Energy Agency (IEA) estimates that global electricity demand from data centres could increase by 945 terawatt-hours (TWh) by 2030, with higher-end projections exceeding 1,000 TWh. For comparison, the United States generated approximately 4,178 TWh of electricity in 2023, a capacity built over more than a century.

Grid pressure drives self-generation

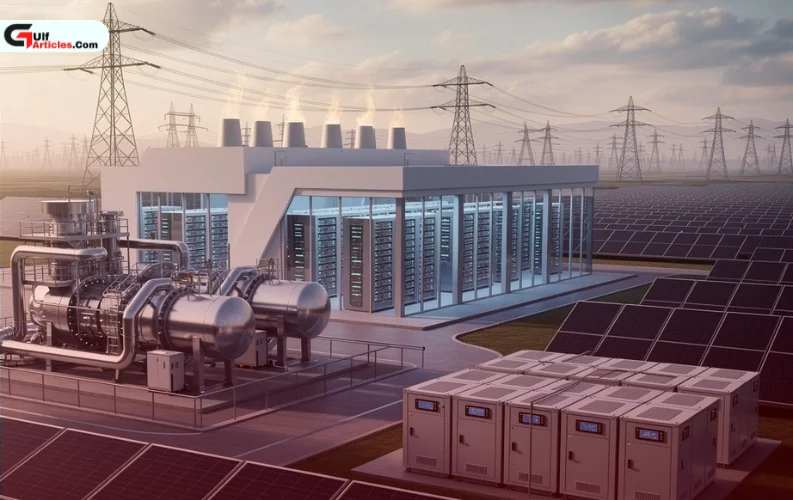

As AI workloads scale rapidly, technology firms are increasingly bypassing traditional utilities by investing in on-site power generation. These projects include natural gas turbines, nuclear reactor restarts, small modular reactors (SMRs), large-scale solar installations and battery storage systems.

Energy analysts describe the shift as a response to both reliability concerns and infrastructure bottlenecks. Securing dedicated power generation allows data centre operators to ensure continuous uptime without relying on congested grids.

S&P Global estimates that data centre power demand increased by 11.3 gigawatts in 2025 alone. AI training workloads are particularly demanding, with individual large-scale models consuming more than 1,200 megawatt-hours during training, while inference requirements continue to grow alongside user adoption.

Power demand projections

United States

-

2024: 183 TWh (around 4–4.4% of national electricity use)

-

2026: 300–400 TWh

-

2030: 426 TWh, representing up to 12% of total electricity demand

Global

-

2022: 460 TWh (around 1% of global electricity use)

-

2026: approximately 1,050 TWh

-

2030: 945 TWh

AI-related workloads are expected to account for 35–50 per cent of data centre electricity use by 2030, up from an estimated 5–15 per cent today.

Major technology investments

In response to these pressures, leading technology companies have announced large-scale power projects between 2024 and 2026:

-

Microsoft – Restarting the Three Mile Island nuclear facility (835 MW) and pursuing nuclear supply agreements exceeding 10 GW.

-

Amazon – Investing in small modular reactors through X-energy and supporting large gas-powered generation projects.

-

Google – Expanding geothermal energy use and evaluating SMR-based nuclear options.

-

Meta – Developing gas-fired power plants exceeding 2 GW and entering nuclear partnerships.

-

OpenAI – Deploying multiple gas turbines to support large-scale AI data centres in the United States.

-

Oracle – Building gas-powered infrastructure for AI-focused campuses.

-

xAI – Adopting on-site gas generation for early AI deployments.

-

Nvidia – Driving higher power density through advanced AI chips, increasing downstream energy requirements.

-

Apple – Expanding renewable energy and battery storage to support hyperscale facilities.

-

Equinix – Integrating natural gas turbines with carbon capture technologies.

Long-term implications

The rapid rise in AI-related power demand is reshaping energy planning across the technology sector. While renewable energy continues to grow at an annual rate of more than 20 per cent within data centre portfolios, gas and nuclear power remain central to meeting immediate capacity needs.

Energy experts warn that without significant upgrades to grid infrastructure, self-generation is likely to remain a core strategy for data centre operators throughout the decade.